When humans and robots come together in hybrid financial services.

It’s an admirable aim. But sadly it’s also one that is proving challenging.

Getting financial advice is still seen very much as the domain of the rich. For the average New Zealander its generally not on the radar.

Can robots and AI help? In a digital world, are we ready for robots to provide us with financial advice?

Minister Kris Faafoi has said he wants Kiwi investors to be wise, informed and motivated.

That’s the conversation we tackled in a recent ‘Rise of the Machines’ panel discussion for the FSC (Financial Services Council) Generations Digital Conference, where I joined Kristen Lunman, co-founder and general manager of investment platform Hatch, Noah Schiltknecht, founder of advisory business Makao Investments, and ANZ head of advisory distribution, Trisha Edmonds in a wide ranging discussion about the future of financial advice and the role technology can play. Ana-Marie Lockyer from AA Money did an outstanding job as the facilitator of the debate.

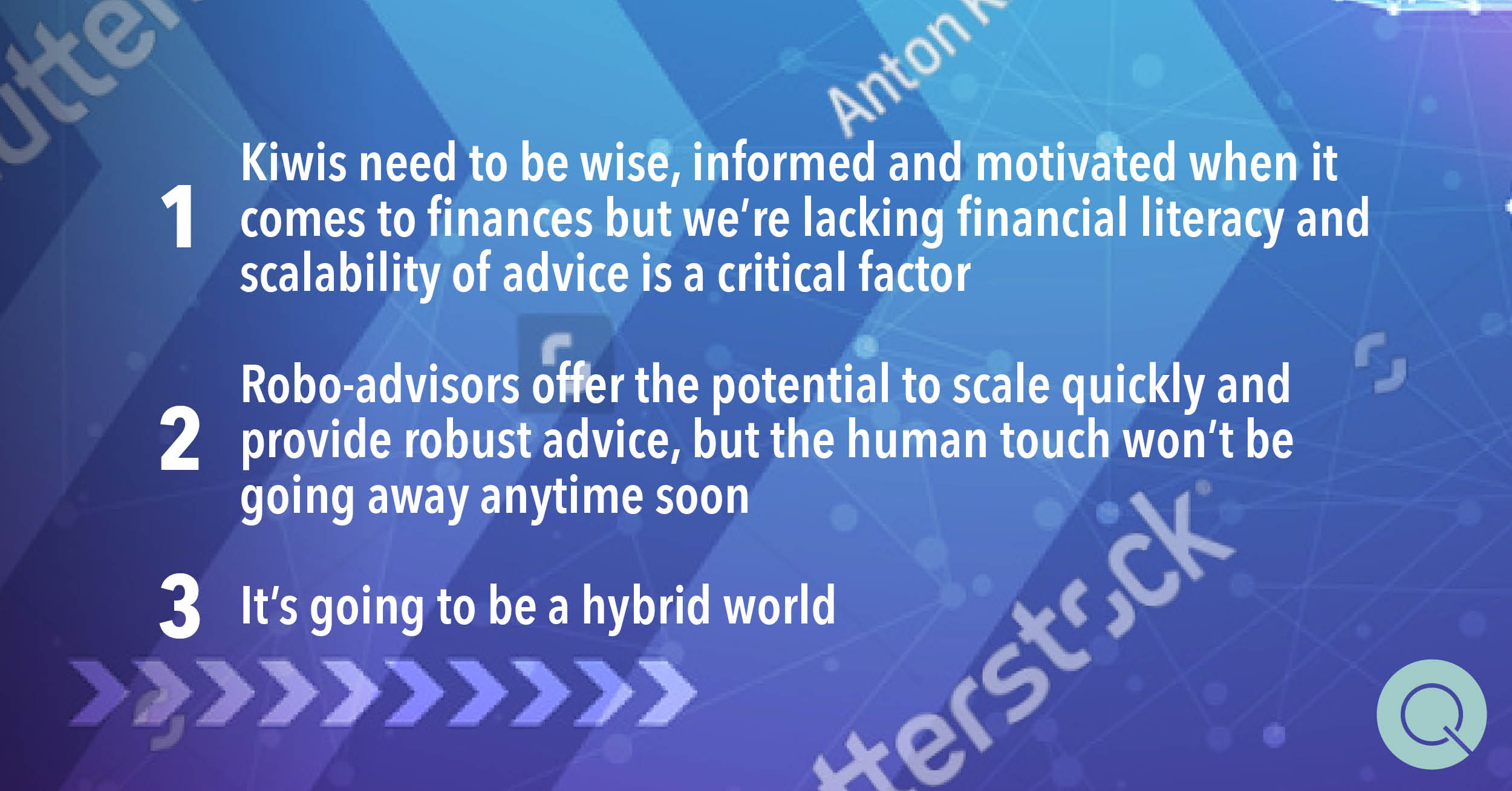

While Noah and Trisha were on ‘Team Humans’ and Kristen and I were ‘Team Machine’ , it was clear that all of us see a future where it’s not a case of one or the other, but instead a hybrid mix of human and robot advice.

So why would we even consider using robots in financial advisory services?

There’s increasing need for financial advice for Kiwis. KiwiSaver has added to the impetus for more financial literacy, but it’s a market with plenty of jargon and complex concepts to get your head around. Add to that the fact that money is an emotional topic for many of us, and you’ve got the makings of a difficult situation.

We’ve already repeatedly seen a lack of maturity - financial advisors note an influx of calls when there’s a dip in the stock market and a flurry of selling indicates investors lack a clear understanding of the market and the fact that selling when the market is low locks in losses.

As Noah pointed out in the panel, letting people deal with investments themselves isn’t always the best idea. With a lack of financial literacy comes the tendency for bad decisions - people often invest in trends they’ve read in the media, forgetting that those trends are the latest hype, and not necessarily sound financially.

But the barriers to advice are high, or at least are perceived to be high, with the expense of accessing personalised advice. Free advice is often tied to the sale of products - a vertical integration which has come under heavy scrutiny by Australia’s Banking Royal Commission.

Providing easy access to smart information to increase both financial participation and literacy is key.

But advice is only good if people know they need to get it, and there’s a wider issue around financial literacy and ensuring that Kiwis know they have to take responsibility for their financial wellbeing, from an early age, and understand what tools are available.

There’s also the issue of scale: There’s a finite number of financial advisors and increasing demand for the advice. The industry needs to be sustainable, but at the same time margins are shrinking.

Kristen summed it up beautifully in the panel discussion: Financial literacy, advice and access to financial resources should be a universal right, and machines should democratise this access.

Technology has always facilitated taking things that were once just for a few to the masses.

Introducing robo-advice

Robo-advice provides personalised financial advice or automated investment planning services through a computer program or algorithm. It can range from basic tools that are narrow in scope to full scale end-to-end investment platforms.

With it comes the potential for a 40-50% cost reductions, greater accuracy and consistency, and unbiased advice (with the proviso that the robots are trained well).

Robots can leverage global know how and expertise – the best of the best – combined with local nous and provide a tailored, multilingual service, on demand. And they’re constantly learning and improving.

They can scale quickly to serve the masses as needed, and importantly in a highly regulated sector, they are fully auditable.

We've seen example where robo-advice has worked well. Consider Charles Schwab, Fidelity Merril, Axos and Vanguard in the United States, and ABM Amro and Santander in Europe. Closer to home Kiwi Wealth and Koura have been the first to harness robo-advisors. Koura enables Kiwi customers to tailor their KiwiSaver scheme to the time horizon and risk preferences. Kiwi Wealth allows investors to set investment goals and build their wealth with actively managed funds.

In fact, McKinsey & Company has said in the United States, uptake of robo-advice is at 50 percent-plus and rising.

The human touch in a hybrid world

It’s clear, however, that machines can’t do everything. The panel agreed that there are times when a personal interaction just can’t be beaten.

Trisha noted that during Covid contact centres saw a surge of calls from people wanting to get confirmation that their investment was ok. The need for human contact and reassurance during times of volatility is high.

Unfortunately, we don’t have enough people to handhold everyone in a crisis. So, we are going to have to scale somehow. And we need to be proactive and be able to see trends coming and go out to clients, rather than being reactive and being swamped when they come to us.

I see the 80:20 rule coming into play – automate the 80% of queries that are relatively straight forward to free people up for the remaining 20% which are more complex or involved.

A Hatch survey found that the most sought after combination was a self-service platform with a human advisor who helps you make investment decisions. second most popular? Making a decision themselves and then checking in with an advisor sometimes to make sure they’re on the right path.

Those are both models we’re already seeing globally. Kristen noted that many US robo-advisory services offer a basic rate (and yes, that’s the one most users opt for) with premium plans enabling customers to call and speak to a person for additional advice. Others charge a monthly fee allowing users to check in with advisors when they need.

It’s about more than financial advice

While our panel discussion was around financial advice, Trisha noted that increasingly financial advisors are becoming counsellors, combining financial advice with wellbeing and life coaching.

Indeed, at least one US financial platform for women has a life coach as part of the platform offering. Investing is just one part of wealth generation after all, and there’s a need for career advice, budgeting information… It’s the modern way of looking at things.

Can a robot handle that? Again, we come back to the hybrid model and the likely need for human touch points.

Let’s be clear. Robots aren’t about to kick Kiwi financial advisors out of their jobs. There are still challenges to be overcome, including the need for coherent, clean data and supervised and/or reinforced learning models to ensure robots are well trained and their advice isn’t biased.

Given we’re in the very early days of robo-advice, trust is still an issue. Kristen likened it to the early days of Uber and Airbnb when concerns around those platforms were high and trust issues had to be overcome. Fast forward a few years and we’ve all embraced the sharing platforms.

And while millennials might be more than happy to embrace digital, older generations are still more likely to favour the human touch.

But for simple investment solutions, when people know what they want, robo-advice can be a winner.

The Covid-19 pandemic has also driven New Zealanders willingness to receive advice through digital.

In time, I believe we will see robots handling increasingly complex financial advice and products. That’s the future. And hopefully, it’s a future of proactive services and increased financial literacy and security for all.